Executive Summary:

Pricing a product is in itself a very challenging task to survive in a high-velocity consumer market and as it is difficult to do it properly due to which many retailers are unable to keep up with the dynamic nature of the market. As price is dependent on a number of factors such as location, trends, season, weather, willingness to pay, demographic features of the customer, and much more, it is very important to consider as much information as possible to stay ahead of the competitors on a dynamic basis. For the retail industry, dynamic pricing is considered more profitable than other pricing methods. What with the continuous flow of data, an increasing number of variables, time requirement to do changes in pricing manually, and the other associated difficulties, it becomes imperative that machines take over the job of assisting the finalization of the dynamic pricing by learning the impact of the dynamic shifts in the customer behaviors and other parameters.

Introduction:

Pricing an item “correctly†is an integral part of revenue management or profit maximization for any business. Both external and internal factors are the determining factors for price. External Factors such as seasonality, weather, location, trends, competitors, customer-related information like demographic features, income, willingness to pay, and Internal Factors include production costs, promotions, sales targets, the brand are some of the important features which play an important role while determining the optimum price of a commodity at any given period of time.

A lot of pricing models created and implemented in the industry today which are based on heuristic and target (store or category) oriented and often set to match the price of the competitors. By following this process, the model and the planner can be unknowingly pulled into a trap of incorrect pricing and end up facing unwanted outcomes. For example, to meet absolute margin targets, the pricing could be higher compared to the competitors or what the customer may be willing to pay and thus end up making fewer sales. If the price is kept lower to meet sell out target or revenue target, retailers make less profit.

Let us understand the dynamics of pricing but before that, some of the assumptions and constraints that are to be considered are as follows:

Assumptions:

· No retailer is disrupting price to the extent of breaching MSP (Manufacturer Selling Price).

· MSP had been constant for all the players.

· Enough inventory is available to meet the demand.

· Pricing is done in accordance with maximum throughput (considering appropriate merchandise mix).

Constraints:

· Saturation of Demand after a certain discount.

· MSP

· Maximum possible unit sales (minimum of throughput or footfall in case of physical store, page views in case of e-commerce)

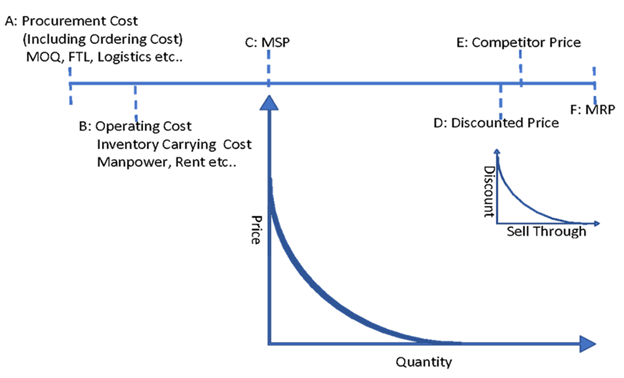

· Targeted absolute margin for the items

The MSP can also vary from one manufacturer to another depending on the factors related to them including the market share as well as production capabilities. But even after assuming that this is the same for all manufacturers the dynamic nature of the market persists. The pricing must be somewhere between MSP(Manufacturer Selling Price) and MRP(Maximum Retail Price). The price curve within this price range gives the associated elasticity of demand. The revenue, profit, and sales velocity maximization must be done within this range. Besides, the sales velocity is dependent on and increases with higher discounts, however, it can potentially reduce profits. Also, a lot of factors like impulse buying, marketing impact on consumer behavior, regional preferences, etc happens which is difficult to model.

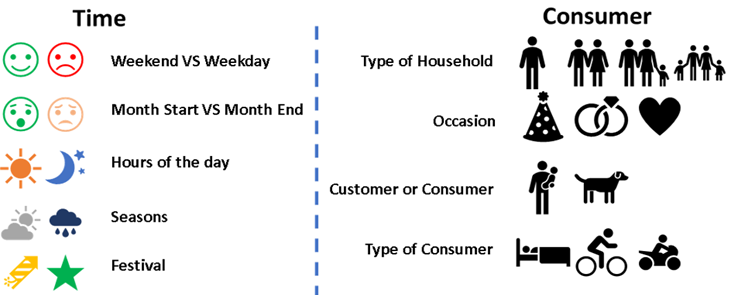

As we can see, for any cluster of Demand, pricing is multi-dimensional. Further, a lot of variables affect demand which cannot be controlled but only adapted to and planned accordingly. These include time parameters such as weekday vs weekend, the start of the month vs month-end, intraday fluctuations, rains and climate factors, festivals, etc. On the customer front, there can be the household status of the customers, special or personal events and the idiosyncrasies of the customer like taste and preferences, etc.

For dynamically pricing the products, the purchase pattern of the consumer should be detected and responded quickly. An appropriate pricing strategy must be implemented for a given cluster of products (Example: Toys for toddlers on Christmas Eve) which may be applicable only for a specific customer segment and duration.

Hence, beyond the price and discount curves, there are other factors that must be considered to achieve a system-wide optimization, which may not be possible to explicitly model as a constrained optimization problem. Machine Learning yields well to handle such a situation and build appropriate models.

Machine Learning helps to design a system that can upgrade itself at given frequency, learn and establish necessary changes to achieve multiple objectives of profit, sell-through and revenue targets and overall optimization in terms of absolute margins. Hence, it becomes imperative that retailers test and try machine learning-based dynamic pricing models to see if a substantial improvement can be obtained from their existing models and business performance indicators.

Conclusion:

Price optimization can lead to different price strategy and a dynamic pricing strategy is highly beneficial to a retailer if they can make use of most of the known features affecting the same. Machine Learning can equip itself with all the dynamics in data and produces more reliable and relevant observation from it. Amazon, Walmart, Uber, etc are using dynamic pricing for their products and services, as a result, their profit has gone up to a significant level. When it comes to pricing every retailer had to think as it not something which is one-size-fits-all. Every business has its unique goals and requirements and due to high competition, they are decreasing their margins. This may put on hold their growth and set them on back-foot. Machine Learning techniques can help them to make their decisions more accurate and achieve their targets with much less effort.